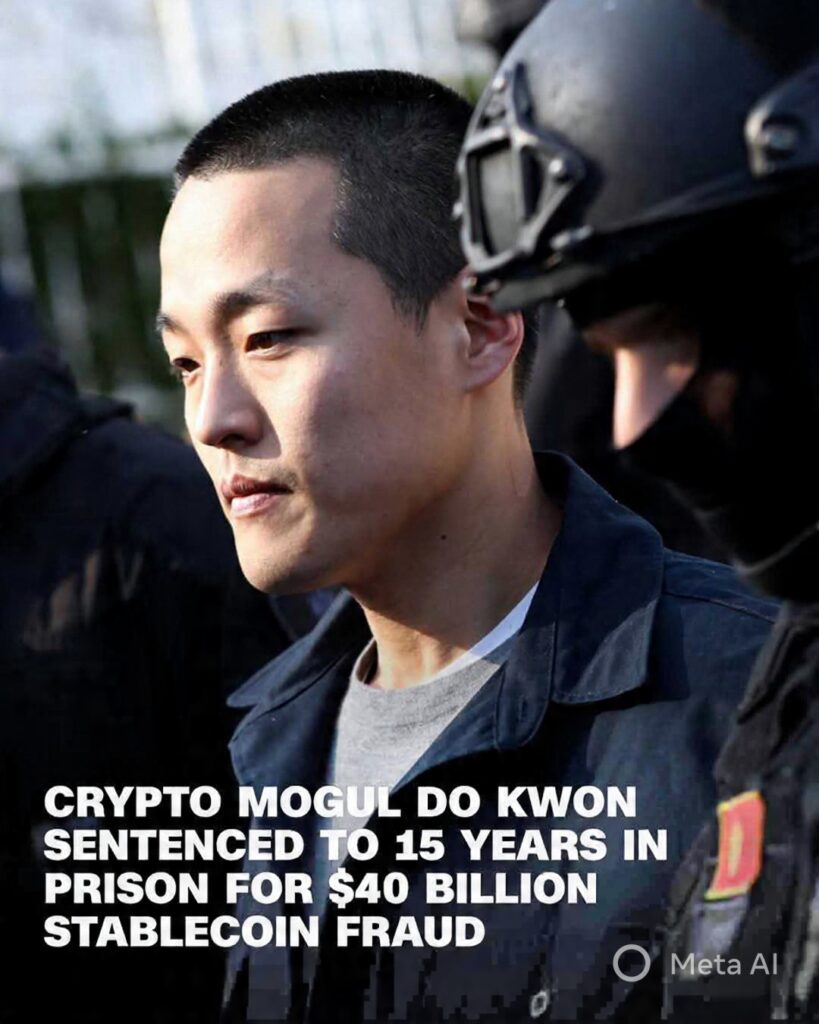

In a case that has sent shockwaves through the financial technology sector, a 34-year-old fintech entrepreneur is facing mounting allegations of orchestrating an elaborate investment fraud scheme that prosecutors say relied heavily on deception, manufactured confidence, and hidden cash infusions.

According to statements from victims and investigators, the accused—once hailed as a rising star in the digital finance world—allegedly leveraged his reputation and personal charm to cultivate trust among investors.

Many of those who came forward described him as highly persuasive, portraying the investment opportunity as low-risk, innovative, and backed by proprietary technology poised to “redefine the future of finance.”

However, authorities say the operation was anything but stable. Court documents reveal that the investment fund appeared healthy only because the entrepreneur secretly funneled large cash infusions into the system, masking significant financial shortfalls and giving the illusion of steady returns.

These undisclosed injections, investigators argue, were used to create an image of legitimacy while preventing early investors from detecting problems.

Victims said the accused “weaponized their trust” in order to secure their participation, often presenting himself as a mentor, industry expert, or personal confidant.

Several investors reported that he framed the venture as a rare opportunity accessible only to a select group—an approach that added pressure to join quickly before the “window closed.”

As the scheme began to unravel, many investors discovered that their funds were either depleted or had been redirected to cover operational losses, personal expenses, or to maintain the illusion of success. The full scale of financial damage is still being assessed, but early estimates suggest losses could reach into the millions.

Legal experts say the case highlights recurring vulnerabilities in the rapidly expanding fintech sector, where innovation often outpaces regulatory oversight. Authorities are urging investors to exercise heightened caution when approached with exclusive or unusually consistent investment opportunities.

The accused has not yet entered a plea, and his legal team maintains that the business faced routine financial challenges rather than criminal intent. Meanwhile, victims continue to push for accountability as the investigation widens.